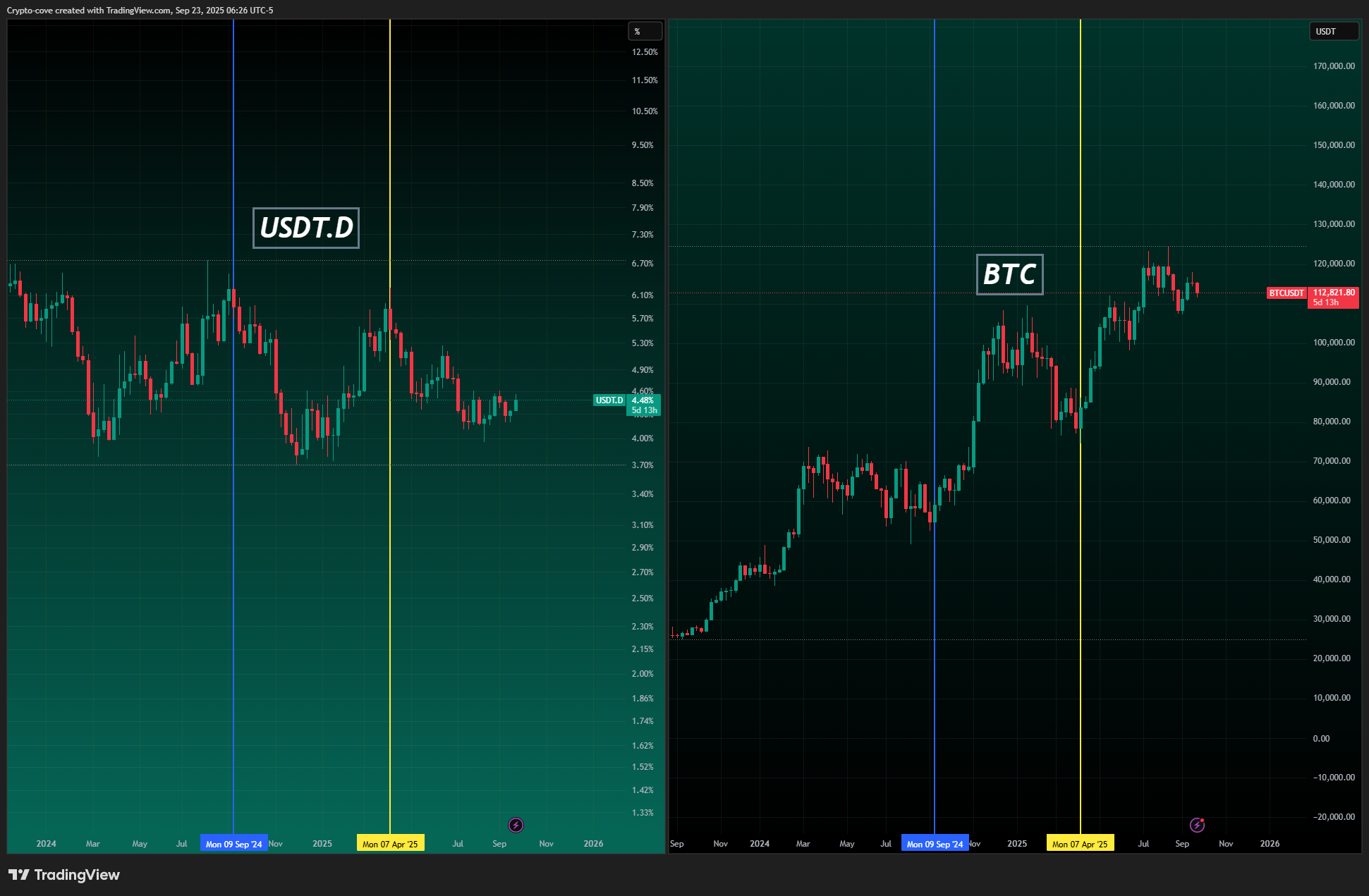

USDT.D and USDC.D represent stablecoin dominance in the crypto market. This shows how much of the total market capitalization is held in stablecoins such as USDT and USDC.

Why Stablecoin Dominance Matters

When investors feel uncertain or consider the market risky, they often sell cryptocurrencies and move funds into stablecoins.

Analysts track stablecoin dominance charts (USDT.D, USDC.D) to analyse overall market conditions. If you know stablecoin trend, you are a king, so always analyse stablecoin dominance before long or short entry. It will increase your accuracy and you will find out the market trend easily.

Market Impact of Stablecoin Dominance

If dominance is rising (bullish): it means more capital is flowing into stablecoins, often leading to a bearish trend in the crypto market.

If dominance is falling (bearish): it suggests capital is rotating back into cryptocurrencies, typically pushing the market upward.

This shows a negative correlation with cryptocurrency:

When stablecoin dominance is bullish (up) → cryptocurrency is bearish (down).

When stablecoin dominance is bearish (down) → cryptocurrency is bullish (up).

Why Traders Should Watch Stablecoin Dominance

Because of this almost 100% negative correlation, stablecoin dominance is one of the most reliable indicators for predicting market direction.

For traders, monitoring USDT.D and USDC.D is essential, as these indicators provide a clear picture of market liquidity and trend direction.

Final Takeaway

In short: stablecoin dominance up = bearish market, stablecoin dominance down = bullish market.